Unleashing the Power of Concentrated Liquidity on a DEX: Exploring its Benefits and Drawbacks

Understand how concentrated liquidity pools work and how you can mitigate the drawbacks.

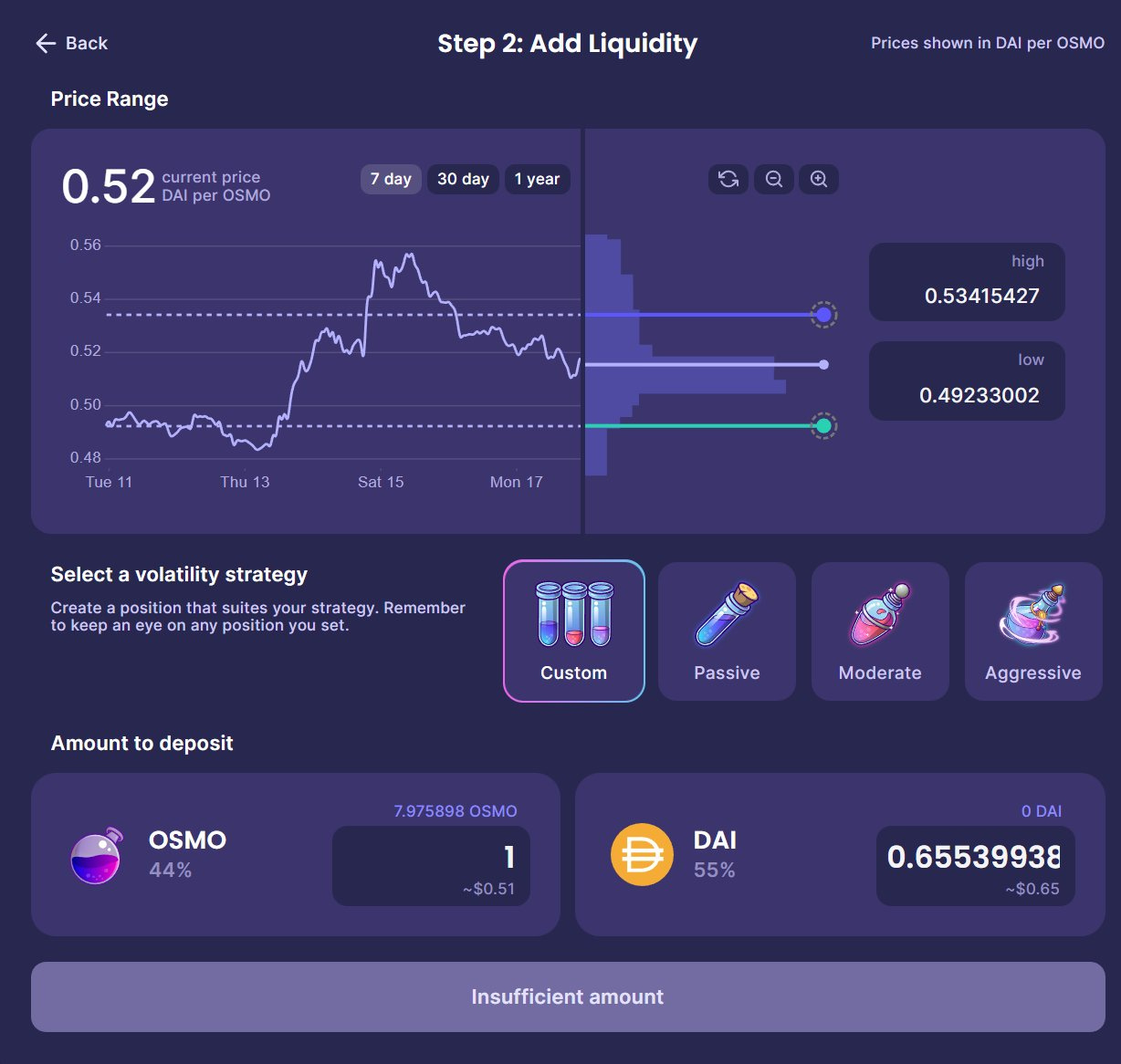

This week Osmosis released its concentrated liquidity model, or Supercharged liquidity as they call it. The model is inspired on Uniswap V3, and even though that has already been live for over two years already, many are still not sure how it works and what are the pros and cons of this model.

In this article I'll break down the differences between both concentrated liquidity and regular liquidity provision, and help you understand which option may suit your trading needs, again not financial advice.

How does liquidity provision work in regular AMM DEXs?

Let's start with the regular liquidity provision, pioneered by Uniswap V1, which is the easiest to understand and the most familiar model. In this approach, liquidity providers deposit their funds into the liquidity pool across all price ranges. When a trade occurs, the DEX matches the buyer and seller, utilizing the liquidity from the pool to execute the transaction. The idea is to distribute liquidity evenly across the price spectrum to accommodate trades of various sizes.

At a technical level, whenever a user provides liquidity to a pool, it receives a so-called LP token, which represents the share of that user in the liquidity pool. In Cosmos, this tokens are usually minted using the cw20 standard and in some more innovative cases, using the Token Factory.

Pretty much every DEX operates this way, as it is the simplest to develop.

Pros of Regular Liquidity Provision

Price Range: regular liquidity provision ensures that trades of different sizes can be executed at various price levels, offering a wider range of options to traders.

Lower Impermanent Loss: Impermanent loss refers to the temporary reduction in value when providing liquidity. Regular liquidity provision tends to minimize impermanent loss as liquidity is spread across different prices.

Cons of Regular Liquidity Provision

Capital Efficiency: regular liquidity provision requires a significant amount of capital to cover a wide price range. This can limit the participation of smaller liquidity providers who may not have sufficient funds to provide liquidity across the entire spectrum.

Lower Fee Capture: Due to the wide distribution of liquidity, regular liquidity provision may result in lower fee capture for liquidity providers, as trades are spread across various price levels.

Concentrated Liquidity

Now, let's dive into the concept of concentrated liquidity. This approach, as the name suggests, concentrates liquidity within a narrower price range. Liquidity providers have the flexibility to choose a specific price range where they want to provide liquidity, often focusing on areas around the current market price.

In this case, the DEX cannot mint cw20 tokens to represent the share of the pool for the user, as the cw20 tokens are generic and don’t contain any information about the price ranges the liquidity was provided for. What it’s used instead is an NFT, i.e. using the cw721 standard.

Pros of Concentrated Liquidity

Capital Efficiency: Concentrated liquidity allows liquidity providers to allocate their capital more efficiently by targeting specific price ranges. This can attract smaller liquidity providers who may not have the resources to provide liquidity across the entire price spectrum.

Higher Fee Capture: Since liquidity is focused on a smaller price range, concentrated liquidity provision increases the likelihood of capturing more trading fees. This can be appealing for liquidity providers seeking higher returns.

Cons of Concentrated Liquidity

Limited Price Range: Concentrated liquidity may result in limited trading options for users, especially for larger trades that fall outside the chosen price range. This could lead to slippage or higher transaction costs.

Increased Impermanent Loss: Concentrated liquidity provision carries a higher risk of impermanent loss, especially if the price moves significantly outside the chosen range. Liquidity providers may experience temporary losses when the market deviates from their selected price range. To be more specific, understand that if the range falls outside of the range you provided, you will end up with a 100% of your tokens on a single asset, at least until the price comes back to the provided range.

Mitigating the drawbacks

So as you could see, both models have benefits and drawbacks, and you really can’t tell one is better than the other, they are just different. Let’s look into how users can mitigate the cons of both models:

Mitigating Regular Liquidity Provision Drawbacks

Pool Selection: Users can choose liquidity pools that align with their trading needs. By assessing the pool's depth, trading volume, and fees, users can select pools that offer a good balance between capital efficiency and a wide price range.

Diversify Investments: Instead of allocating all their funds to a single liquidity pool, users can diversify across multiple pools. This strategy helps reduce the risk of impermanent loss by spreading their capital across different trading pairs and price ranges.

Monitor Market Trends: Keeping an eye on market trends and potential price movements can help users anticipate trading demand and adjust their liquidity provision strategies accordingly. This can be particularly useful for optimizing fee capture and minimizing the impact of impermanent loss.

Mitigating Concentrated Liquidity Provision Drawbacks

Careful Price Range Selection: When opting for concentrated liquidity provision, users should choose a price range that aligns with their risk tolerance and market expectations. Assessing historical price movements and market volatility can help in determining an appropriate range. Osmosis Supercharged liquidity UX is great for this!.

Regular Rebalancing: To mitigate impermanent loss, liquidity providers can periodically reassess their chosen price range and adjust it to account for market fluctuations. Regular rebalancing helps ensure that liquidity provision remains optimal given the current market conditions.

Combine Concentrated and Regular Approaches: Users can employ a hybrid approach by providing liquidity both in concentrated ranges and across a wider price spectrum. This strategy allows for targeted capital allocation while still capturing opportunities in a broader market context.

Bear in mind that these strategies, as the crypto market evolves, are always changing. You should always stay informed about the latest developments in DeFi to stay ahead of the curve.

Wrapping up

In summary, both regular and concentrated liquidity provision approaches have their advantages and disadvantages. Regular liquidity provision offers a wider price range and lower impermanent loss but requires substantial capital and may result in lower fee capture. On the other hand, concentrated liquidity provision allows for capital efficiency and potentially higher fee capture but it might be a nightmare for unexperienced users and pose higher impermanent loss risks.

Stay tuned for an in-depth exploration of this topic, where I’ll dive into smart contract analysis and more. Don't forget to subscribe to stay updated and not miss out on the upcoming insights!